Faced with the hegemony of Tether’s USDT and Circle’s USDC, decentralized finance offers alternatives to these stablecoins centralized. Among the initiatives, Usual and its stablecoin USD0 intend to compete with the centralized giants.

This article is brought to you as part of an educational grant from the Usual Project.

- Common offers a USD0 stablecoin, backed by tangible financial assets (RWA), which challenges centralized giants like USDT and USDC.

- Binance organized the launch of the USUAL governance token with a distribution campaign on its Launchpool and a launch on the Pre-Market platform.

Usual and its stablecoin USD0

Centralized stablecoins have enabled the rise of DeFi in a broad sense. However, they present many limitations. In fact, centralized stablecoins such as USDT or USDC, depends on reserves controlled by private companies. This raises many questions regarding transparency of reserves who will insure the property.

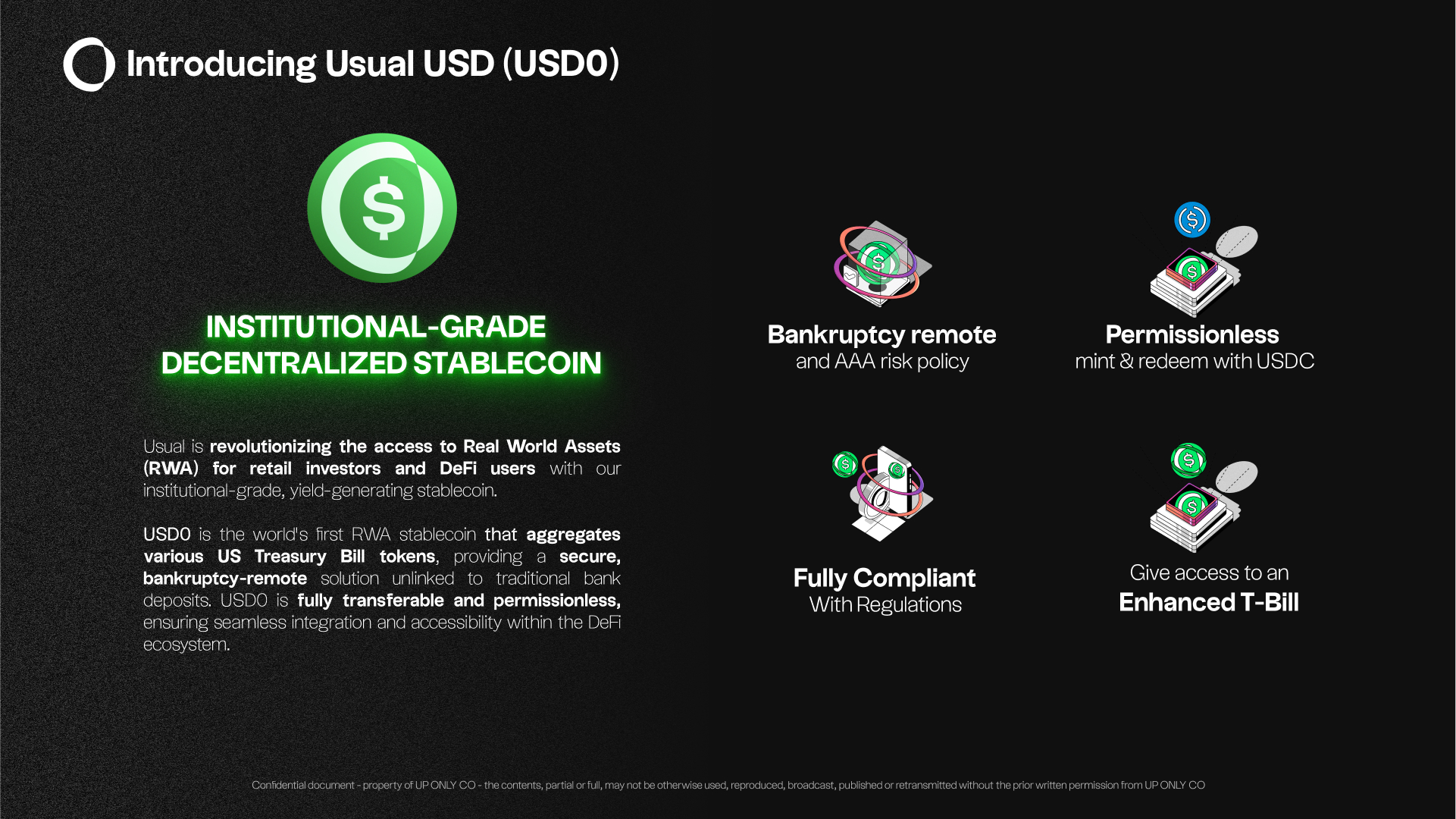

on his part, Common USD0 is a stablecoin backed by Real World Assets (RWA). Unlike traditional stablecoins, USD0 is fully backed by tangible, verifiable financial assets.

In practice, USD0 is mainly supported US Treasuries (US Treasury Bills) in the short term. The term “short-term” is central here, as it protects users from the risks associated with a potential bank failure.

This allows Usual to offer stablecoins that they categorize by “remote bankruptcy”namely that it is designed to remain stable and secure even in the event of banking crises.

Common token launched on Binance Launchpool

In addition to USD0, Usual also has a token of the same name: USUAL. This is a management token which allows holders to participate in decisions regarding protocol development.

In addition, the token is designated capture log value and returns. Through a deflation mechanism that automatically reduces the issuance of new COMMON tokens as the protocol’s TVL and protocol revenues grow.

To run his token, Binance has notification that it would be the first platform on the USUAL list. This will be done in two phases.

USUAL token will be offered on Binance Launchpool from November 15th to 19th. So users will be able to deposit BNB or FDUSD during these 4 days to get REGULAR tokens. In total, 300 million COMMON tokensor 7.5% of the total supply, will be distributed through the Binance Launchpool.

The USUAL token will then be listed on the Binance Pre-Market platformstarting on November 19 at 9:00 a.m. French time (10:00 a.m. UTC). The duration of this Pre-Market and the introduction of the USUAL token to the spot markets will be communicated at a later date.

From their side, Users who participated in the Pills points campaign can see that the drop is fast approaching. In fact, users of the protocol, holders of USD0 or USD0++, will split 7.5% of the USUAL token supply through the airdrop.